In the exciting world of Forex trading, swing trading forex LATAM Trading Platform stands out as a valuable resource for traders eager to elevate their skills. One of the most popular strategies among retail traders is swing trading. This approach allows traders to capitalize on short- to medium-term price movements, making it an appealing method for those who may not be able to dedicate all their time to real-time trading.

Understanding Swing Trading in Forex

Swing trading is a style of trading that aims to capture short- to medium-term market moves. Traders who adopt this strategy typically hold positions for several days to weeks, allowing them to take advantage of price swings that occur within a trend. While swing traders are not concerned with long-term price movements, they employ technical analysis to identify potential entry and exit points.

The Basics of Swing Trading

Before diving into swing trading strategies, it is crucial to understand some foundational concepts:

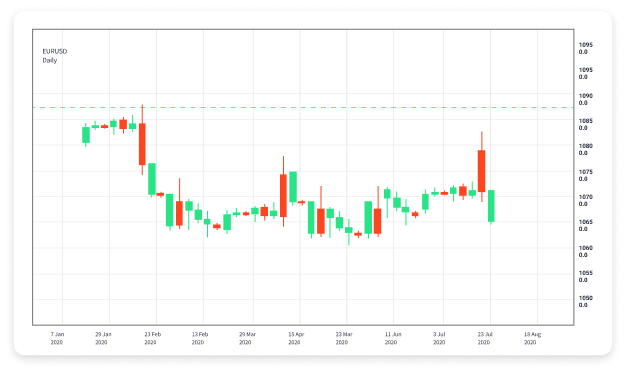

- Time Frames: Swing traders usually focus on 1-hour, 4-hour, or daily charts. These time frames help in identifying trends and price patterns without getting overwhelmed by minute-to-minute volatility.

- Market Analysis: A combination of technical and fundamental analysis is essential for swing trading. Technical indicators provide insights into price movements, while fundamental analysis helps traders stay informed about economic events that could impact currency prices.

- Risk Management: Effective risk management is vital. Swing traders should define their risk tolerance and use stop-loss orders to protect their capital from significant losses.

Key Swing Trading Strategies

There are various strategies that swing traders use to identify potential trades. Here are some of the most effective approaches:

1. Trend Following

One of the most popular swing trading strategies is trend following. This method involves identifying the current market trend and placing trades in the direction of that trend. Traders look for higher highs and higher lows in an uptrend or lower lows and lower highs in a downtrend. This strategy often employs moving averages to help determine the trend direction.

2. Retracement Trading

Retracement trading aims to capitalize on temporary price reversals within a larger trend. Swing traders will look for key support and resistance levels or Fibonacci retracement levels to identify potential entry points during price corrections, allowing them to ride the next wave of the trend.

3. Breakout Trading

Breakouts occur when the price moves beyond a defined support or resistance level, indicating a potential new trend. Swing traders can take advantage of breakouts by entering trades right after the price surpasses these key levels, anticipating that momentum will carry the price further in that direction.

Key Indicators for Swing Trading

Technical indicators play a significant role in swing trading. Below are some key indicators that can enhance your trading strategy:

1. Moving Averages

Moving averages, such as the 20-day and 50-day, provide insights into market trends. They can help traders identify entry and exit points by smoothing out price data and indicating potential reversals.

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions, helping traders anticipate potential reversals.

3. Bollinger Bands

Bollinger Bands consist of a middle band (the moving average) and two outer bands that represent volatility. When the price approaches the upper band, it may indicate overbought conditions, while approaching the lower band may signal oversold conditions.

Advantages of Swing Trading

Swing trading offers several advantages that make it appealing to many Forex traders:

- Flexibility: Swing trading does not require constant monitoring of the markets, making it suitable for individuals with other commitments.

- Potential for Higher Returns: By capturing larger price movements, swing traders can potentially realize more significant profits compared to day trading.

- Less Stressful: Since swing traders hold positions longer, they are less affected by the short-term market noise that often impacts day traders.

Challenges of Swing Trading

Despite its advantages, swing trading also presents challenges that traders should be aware of:

- Market Volatility: Swing traders may find their positions affected by sudden market shifts or economic news, necessitating effective risk management strategies.

- Timing the Market: Successfully entering and exiting trades can be challenging, and poor timing can lead to missed opportunities or losses.

- Emotional Discipline: Swing trading requires patience and discipline. Traders may be tempted to abandon their strategies in the face of market fluctuations.

Conclusion

Swing trading in Forex can be a profitable venture for traders who are willing to dedicate time to learn the mechanics of the market. By understanding key strategies, utilizing technical indicators, and managing risk efficiently, traders can harness the power of swing trading to achieve their financial goals. Whether you are new to trading or an experienced trader looking to diversify your approach, swing trading offers valuable opportunities to engage with the Forex market effectively.

To succeed in swing trading, consider exploring various resources, and don’t hesitate to try out different strategies on a demo account before committing real funds. With practice, the discipline to follow your plan, and a good understanding of market dynamics, swing trading can become a rewarding skill in your trading arsenal.