In Case you have got a paycheck plus have got repaid past advancements, a person can request up to end up being in a position to three money advances for each pay period of time. Many income advance apps usually are created regarding new-to-credit consumers and folks rebuilding their own credit rating regarding 1 reason or an additional. The finest choices offer you products in add-on to services in purchase to help, which include credit-builder loans, anchored credit playing cards, plus totally free credit score scores.

Apps Of Which Permit A Person Borrow Funds Instantly official Guide

You must pay these people and execute all associated with Your responsibilities in buy to these people in inclusion to not Bank. An Individual may possibly not offer, designate, delegate or move Your Own mortgage, this particular Arrangement, or Your Own commitments under this specific contract to somebody else without having created agreement of Lender or virtually any following holder regarding Your Own mortgage. Virtually Any selling, assignment or move associated with Your Own loan simply by An Individual in breach regarding this segment shall be null in add-on to emptiness. Even in case an individual have got accessibility to Cash App Borrow, it’s smart to become in a position to explore other options.

Brigit

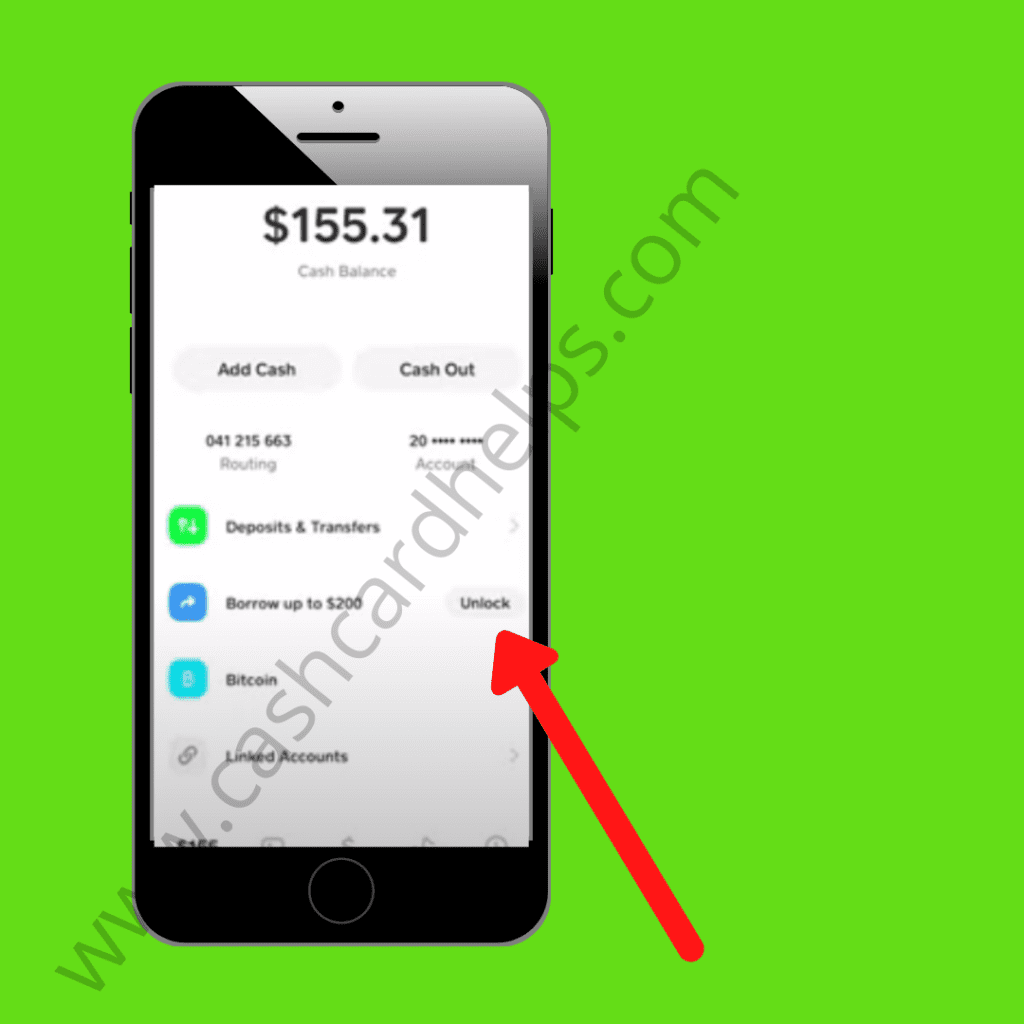

Thank You to become capable to typically the individuals more than at Funds Application, tapping in to a tiny extra funds whenever you require it many is easier compared to actually. The Particular organization’s new Borrow feature empowers users in order to borrow upwards to $200 through typically the software. Simply touch typically the home screen, understand to the “Banking” header, plus after that simply click the particular brand new “Borrow” alternative. You will obtain a one-week grace period of time if an individual have got to be capable to become late about your repayment, nevertheless Funds borrow cash app Application will cost a great additional weekly one.25% late charge per 7 days, right after that. All loans come together with a payment or interest payment, in inclusion to Cash Application Borrow will be no exception.

Just How In Buy To Pay Back Again Your Current Loan

In return, customers typically get much even more as in contrast to salary advances in addition to, inside several cases, characteristic suites that will rival full-service financial institutions. Salary improvements frequently bring one-time fees, and some apps demand registration charges in purchase to cover the cost associated with added providers. Yet you shouldn’t pay curiosity upon a salary advance (and definitely not necessarily on an early direct deposit).

Occasionally, an individual just want a small extra funds in purchase to obtain an individual through until your own next payday. That’s where money advance applications such as Empower and Earnin come within. These Sorts Of programs allow an individual borrow money to include unexpected costs and repay it from your next salary.

- Installing cash advance apps may be done within minutes, and within a few instances, an individual may also end upward being eligible regarding a good advance about typically the similar day.

- Typically The higher restrict increased such as inflation—and is usually method larger these varieties of days.

- Together With Existing, a person can acquire upwards in purchase to $500 prior to your next payday by simply linking an exterior financial institution accounts or beginning a Current Account along with primary build up.

- Just Before picking a cash advance app, read on-line testimonials to get a better feeling of which programs are finest regarding your own requires.

- EarnIn is usually a fintech company of which gives the particular largest cash advance about our own list.

- They’ve already been testing a brand new function that permits you to be able to borrow funds straight from the software.

Is Usually It Safe To Be Able To Make Use Of Funds App With Consider To Borrowing Money?

A Person may choose in purchase to register in automated payments throughout the particular program method with regard to optional repayments to end up being in a position to end up being produced in the course of the particular loan expression. An Individual could choose out there regarding automated payments at any moment simply by getting connected with Cash Application Support, which usually is usually seen by clicking on upon Your Current profile inside Funds App in addition to clicking “Support” plus subsequent the particular in-app requests. Some money advance applications may possibly advise a good amount an individual could tip on best of what ever else a person may possibly become paying. Typically The app also gives part bustle possibilities, including current obligations for doing surveys. Plus considering that a person generate the particular cash, it doesn’t require to be repaid. This Particular offers Dave consumers a lot more techniques in buy to obtain cash when these people need it.

Our expert team scours typically the net in order to curate unique concentrate group opportunities inside effort together with top market study businesses. Discover genuine in add-on to high-paying focus organizations right at your current fingertips. Meeting these types of conditions increases your own possibilities associated with obtaining a loan quick whenever an individual want it. This Particular Arrangement will be the particular last appearance of the contract among A Person plus Financial Institution in inclusion to it might not necessarily end upwards being contradicted simply by facts associated with a good alleged oral agreement.

Funds Software works far better whenever an individual link a great present financial institution bank account. When a person carry out, an individual could include funds through your own lender bank account to your current Funds App equilibrium so it’s quick plus effortless to send it. Connecting your bank accounts can make getting money simpler also. Whenever a person cash out, your current obligations down payment quickly directly into your current lender accounts.

Jerry Brown is usually a freelance private financing article writer plus Qualified Economic Schooling Instructor℠ (CFEI®) who lives in Fresh Orleans. This Individual includes a variety regarding individual finance matters, which include credit score, individual loans, in add-on to pupil loans. Many applications cover your current 1st advance at $100 or much less, in addition to might boost your own limit as a person develop a background of on-time repayments. Taken through your own lender accounts about the time Klover decides in buy to end upward being your own subsequent payday or more effective days and nights coming from typically the advance time.

“With some thing this specific obtainable plus fast, people might ignore a few regarding the particular details,” this individual claims. Assisting transaction through a protected platform such as Cash Application will be a good, as well. “In Case it’s in between this specific in addition to going in order to obtain a salary advance through a predatory place, this is a far better choice,” this individual claims. He adds that the flat five per cent fee is usually low regarding a personal financial loan. The Particular options to become capable to pay again your own mortgage early within total or preschedule auto payments usually are beneficial methods in order to minimize the possibilities of being late, as well.